PUBLICATION – Patent Privateering

Hervouet, Lorenzon, Righi, and Sterzi (2023). Patent Privateering. Bordeaux Economics Working Paper,...

28 Settembre, 2023 publications1. Patent privateering can be a strategic and anti-competitive tool employed by some operating companies.

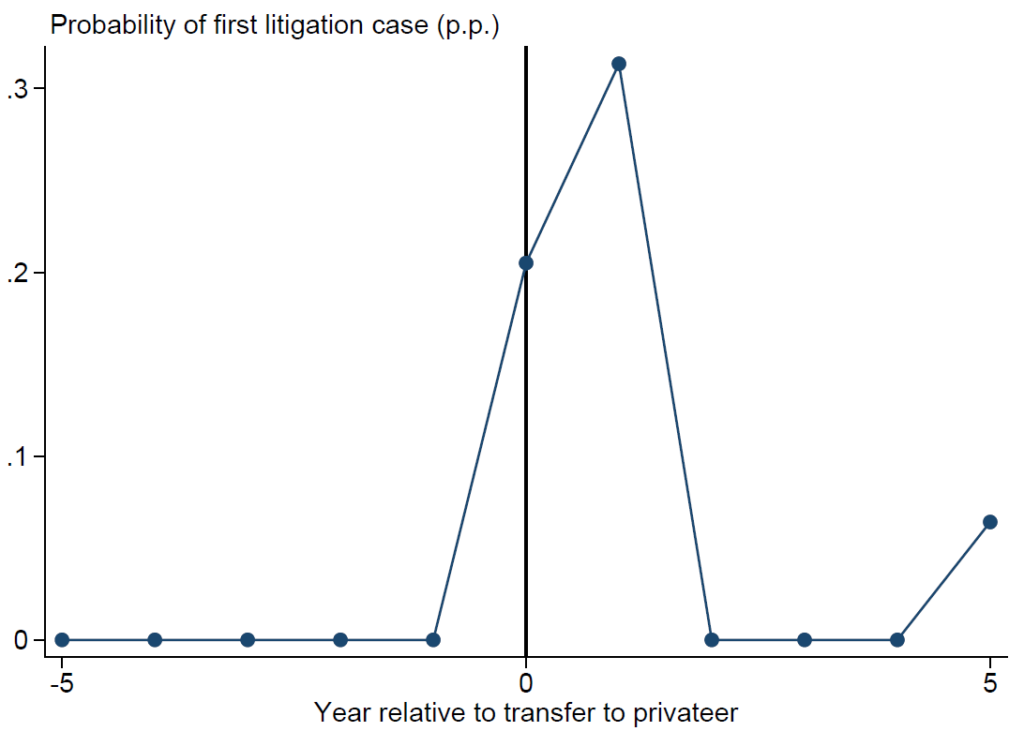

We analyse data on European patent transfers and patent infringement litigation in five large European jurisdictions in 2010-2020 in order to study operating companies’ delegation of patent enforcement to patent assertion entities, a practice called “patent privateering. We find that patent privateering is widespread in our empirical setting, systematically different from other transfers to PAEs, and enforcement through a privateer is more likely to occur when the economic private value of the patent is relatively low, the patent has been declared essential for a technical standard, and the target of the patent infringement lawsuit is a competitor of the original patent owner.

Our results suggest that patent privateering can be a strategic and anti-competitive tool employed by some operating companies.

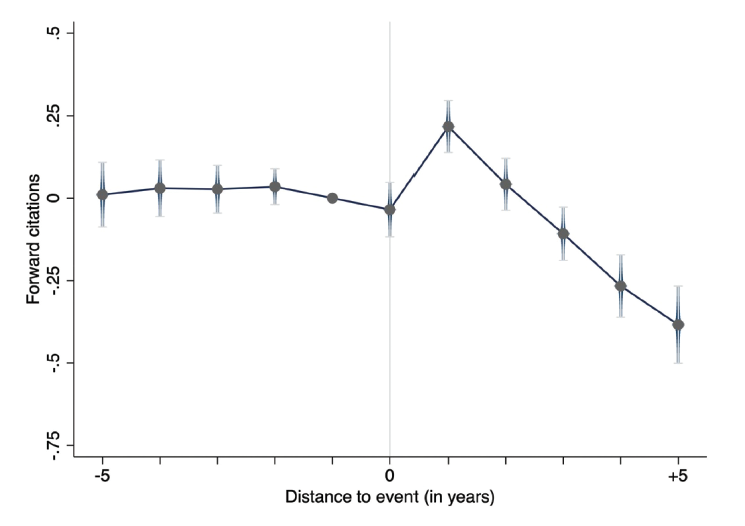

2. The impact of PAE patent acquisition on follow-on innovation is negative

This paper uses an original database of US patents reporting PAE patent acquisitions. We document two key empirical facts about the presence of PAEs in the market for patents. First, PAEs build large patent portfolios and contribute significantly to patent transfers in the US. Second, their impact on follow-on innovation is, on average, negative. With a series of dynamic diff-in-diffs analyses, we estimate a significant post-transfer drop in forward citations received by patents acquired by PAEs.

This drop is not immediate but takes some years to materialise. Heterogeneity tests show that our results are driven by

acquisitions of old and highly cited patents, as well as by patent acquisitions by large patent aggregators.

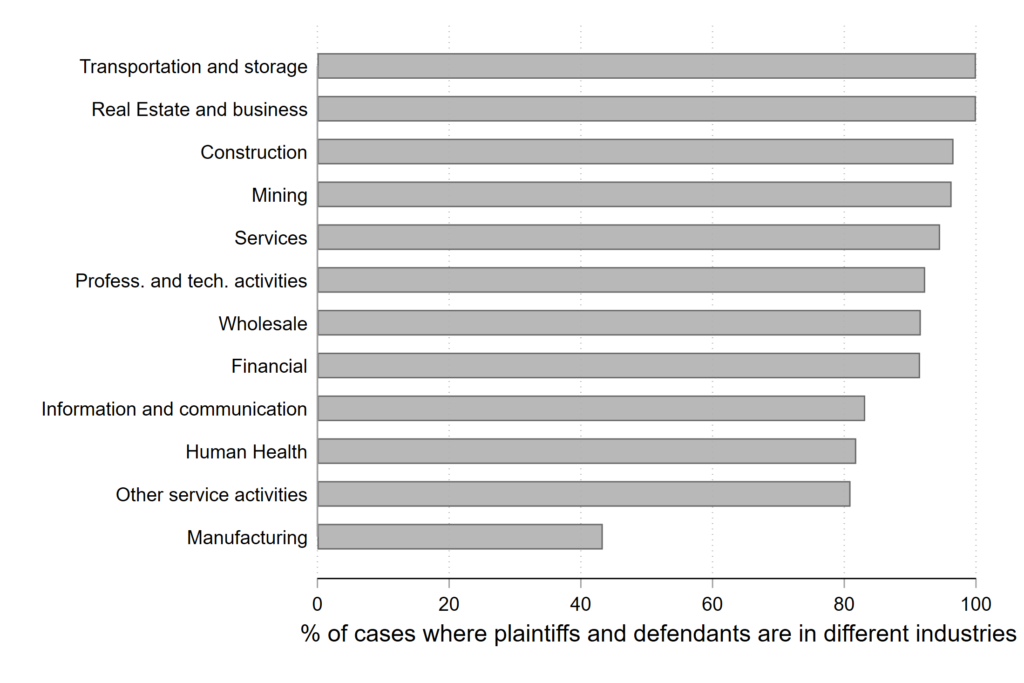

3. Plaintiffs and defendants in patent litigation cases in Europe operate in different industries in almost 75% of cases, with significant variability across industries and technological fields.

The figure shows the percentage of cases where plaintiffs and defendants are in different industries, by defendants’ industry. Years: 2010-2019. Jurisdictions: DE, FR, IT, NL, UK

This study examines infringement actions initiated between 2010 and 2019 in five large EU jurisdictions (France, Germany, Italy, Netherlands, United Kingdom) where at least one patent granted by the European Patent Office (EPO) is involved.In this paper, we look at characteristics of the pairs of firms (plaintiffs and defendants) involved in lawsuits.The analysis reveals that the plaintiffs and defendants operate indifferent industries in almost 75% of cases, with significant variability across industries and technological fields. The econometric results show that these cases are associated with patents of relatively low economic value, that are old and where settlement is less frequent.Overall our results suggest that manufacturers need to sustain high costs to thoroughly verify that their innovations are not infringing on any existing patents and that, despite these costs, they may infringe inadvertently.

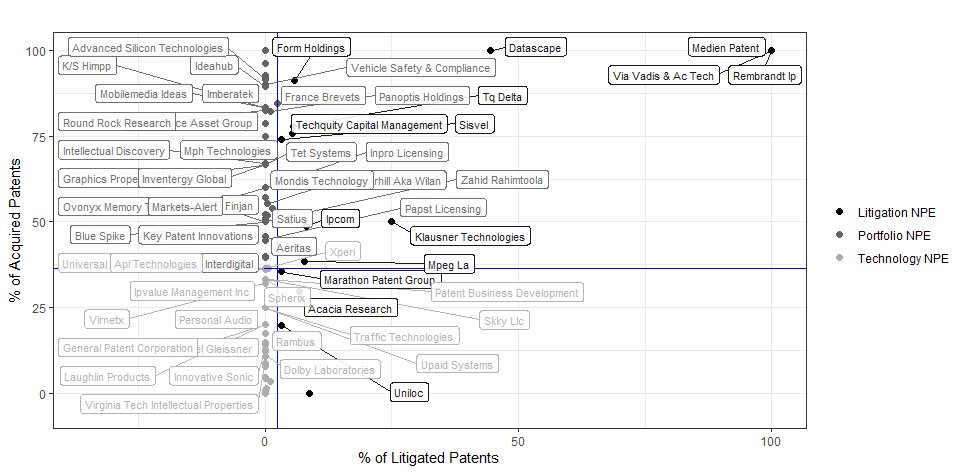

4. In Europe PAEs have acquired about 3% of transacted patents (9% in the Electrical Engineering area) in the last decade.They’re very heterogeneous with respect to their patent acquisition strategies and use of the acquired patents.

The contribution of PAEs to the patent market in Europe is about 3% in last ten years. Moreover, this share goes up to almost 9% in the case of patents in the Electrical Engineering area, with two peaks of 15% and 25%, respectively, in 2014 and 2019. Concerning the origins of those acquired patents, a large share of patents acquired by PAEs originate from large European product companies operating in the ICT industry, downplaying the rhetoric that PAEs acquire patents mainly by inventors and SMEs.

Moreover, we also highlight that PAEs are very heterogeneous among them in terms of the choice of the patents acquired and of the use of these patents. In particular, we show that PAEs with higher litigation propensity (in contrast to patent aggregators or technology companies) tend to procure patents that exhibit a higher risk of infringement. Furthermore, these patents have comparable technological quality to those acquired by practicing entities and are associated with a reduction in the subsequent use of the acquired technologies. By contrast, PAEs that invest in R&D acquire high-quality patents and are not associated with a reduction in their use after the acquisition

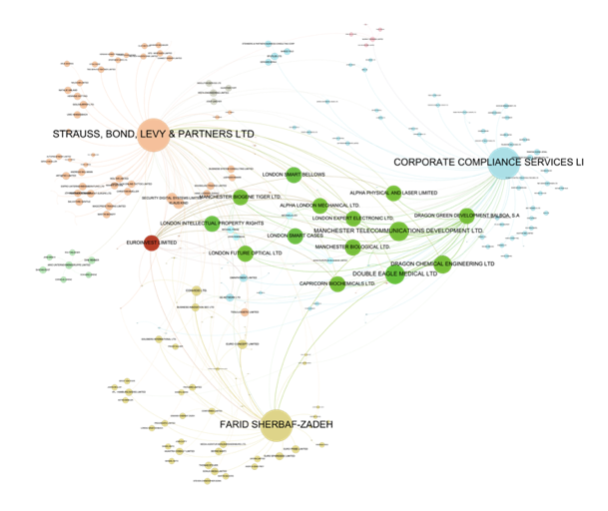

5. NPEs REGISTERED AS DORMANT COMPANIES IN THE UK OWN HUNDREDS OF PATENTS AT HIGH RISK OF BEING INFRINGED

We identify and characterize the patent portfolios of NPEs registered as dormant companies in the UK and investigate whether they are created for the purpose of acquiring valuable IP assets or launching litigation campaigns. Our econometric analysis – based on more than two hundred NPEs registered as dormant companies in 2019 – supports the second hypothesis.

Hervouet, Lorenzon, Righi, and Sterzi (2023). Patent Privateering. Bordeaux Economics Working Paper,...

28 Settembre, 2023 publicationsOrsatti, G., & Sterzi, V. (2023). Patent assertion entities and follow-on innovation. Evidence f...

26 Maggio, 2023 publicationsSterzi, V., Maronero C., Orsatti G., & Vezzulli A. (2021). Non-Practicing Entities in Europe: an...

08 Novembre, 2021 publications